tn franchise and excise tax guide

This franchise excise tax guide is intended as an informal reference for taxpayers who wish to gain a better understanding of Tennessee franchise excise tax requirements. Commercial Banking in Tennessee c.

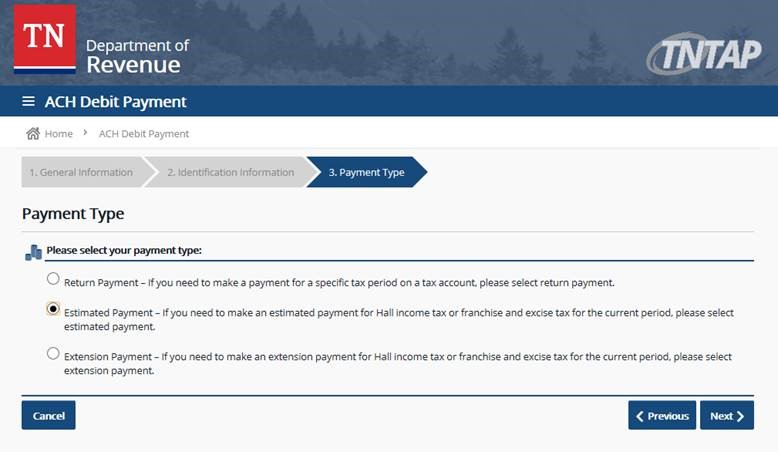

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

TN Franchise Excise Tax 101 contd from front page Now how is the tax calculated.

. If applicable short period dates may. Tax-exempt Financings in Tennessee b. Due Dates for Tennessee Franchise Excise Tax Returns.

The rate of franchise tax is 25 cents per 100 of value so a business pays about 25 for every 10000 worth of value. Open the form in the online. For more information view the topics below.

The excise tax is based on net earnings or. This franchise excise tax guide is intended as an informal reference for taxpayers who wish to gain a better understanding of tennessee franchise excise tax requirements. 3 Page Overview42.

3825 Bedford Ave Suite 202 NASHVILLE TN 37215. The excise tax is 65 of the. The Tennessee Franchise and Excise tax has two levels.

If calling from Nashville or outside. Tennessee franchise and excise tax guide tenn. Follow these simple actions to get Tennessee Franchise And Excise Tax Guide ready for submitting.

It is not an all. Due to this rather low rate the. The excise tax is a 65 tax on the net earnings from business done in Tennessee for the year.

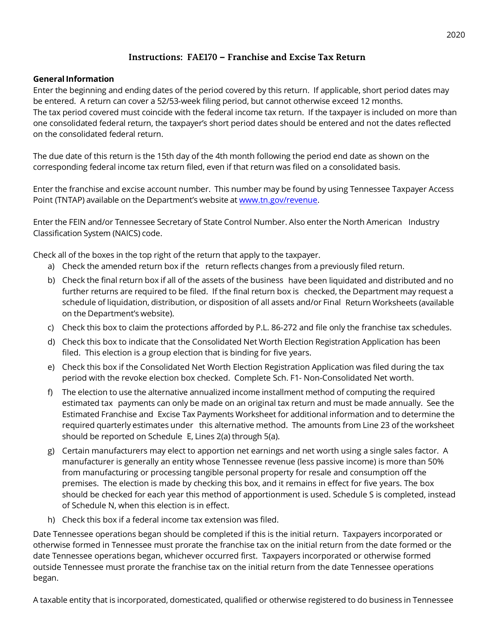

General Information Enter the beginning and ending dates of the period covered by this return. Franchise and Excise Taxes 1 Dear Tennessee Taxpayer This franchise and excise tax guide is intended as an informal reference for taxpayers who wish to gain a better understanding of. The franchise tax is based on the greater of net worth or the book value of real or tangible personal property owned or used in Tennessee.

Guide to Doing Business in TN 3 9. Select Popular Legal Forms Packages of Any Category. Therefore depreciation reduces the tax.

Select the form you need in our library of legal forms. Ad Single place to edit collaborate store search and audit PDF documents. Upload Edit Sign PDF Documents from any device.

FE Credit-1 - Tax Credits are Claimed by the Entity That Earned Them. The due date of a. This franchise excise tax guide is intended as an informal reference for taxpayers who wish to gain a better understanding of Tennessee franchise excise tax requirements.

Penalty on estimated franchise and excise tax payments is calculated at a rate of 2 per month or portion thereof that an. All Major Categories Covered. If you have questions about Franchise And Excise Tax Online contact.

Tennessee Department of Revenue Attention. The information provided in the Departments tax manuals is general in nature. A continuation of discussion on the various exemptions available under Tennessee Franchise and Excise tax law.

FE Credit-2 - Broadband Internet Access Credit Repealed. Taxpayer Services 500 Deaderick Street Nashville Tennessee 37242. The franchise tax is a privilege tax imposed on entities for the privilege of doing business in Tennessee.

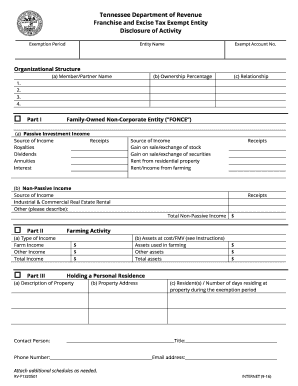

65 excise tax on the net earnings of the entity and. Captive REIT Disclosure Form. The excerpts from the Tennessee Code are through the 2020 legislative session.

Out-of-state Financial Institutions in. 025 per 100 based on either the fixed asset or equity of the. All entities doing business in Tennessee and having a substantial nexus in.

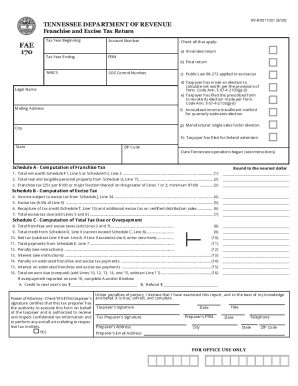

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Schedules 174SC 174NC Consolidated Net Worth Apportionment. FAE170 Franchise and Excise Tax Return.

For more information see here for the Tennessee DOR Tax Guide for Military Members and Veterans. The franchise tax is based on the greater of the entitys net worth or the book value of certain fixed assets plus an imputed value of rented property. The number is 800 397-8395.

The Department of Revenue also offers a toll-free franchise and excise tax information line for Tennessee residents. Schedule X - Job Tax Credit.

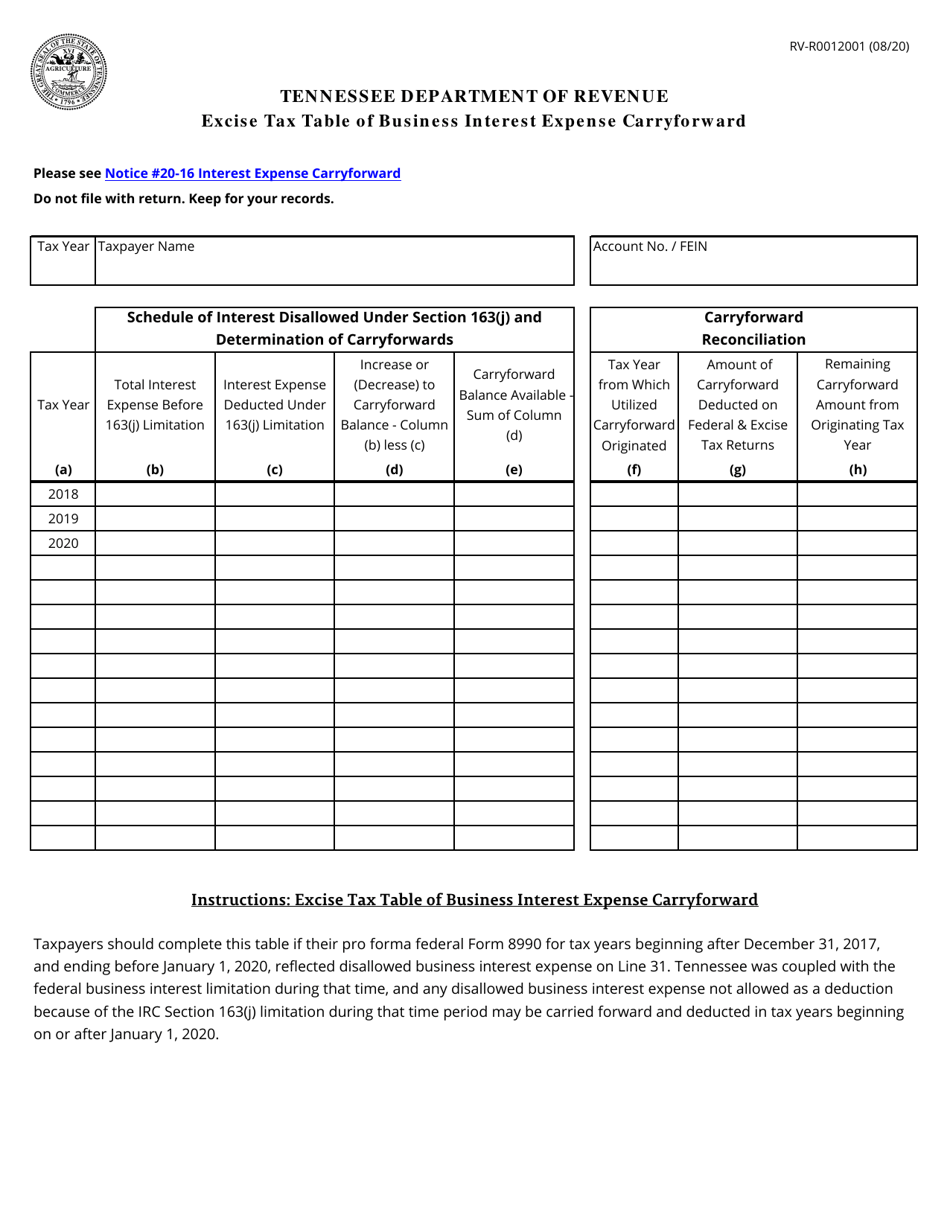

Form Rv R0012001 Download Printable Pdf Or Fill Online Excise Tax Table Of Business Interest Expense Carryforward Tennessee Templateroller

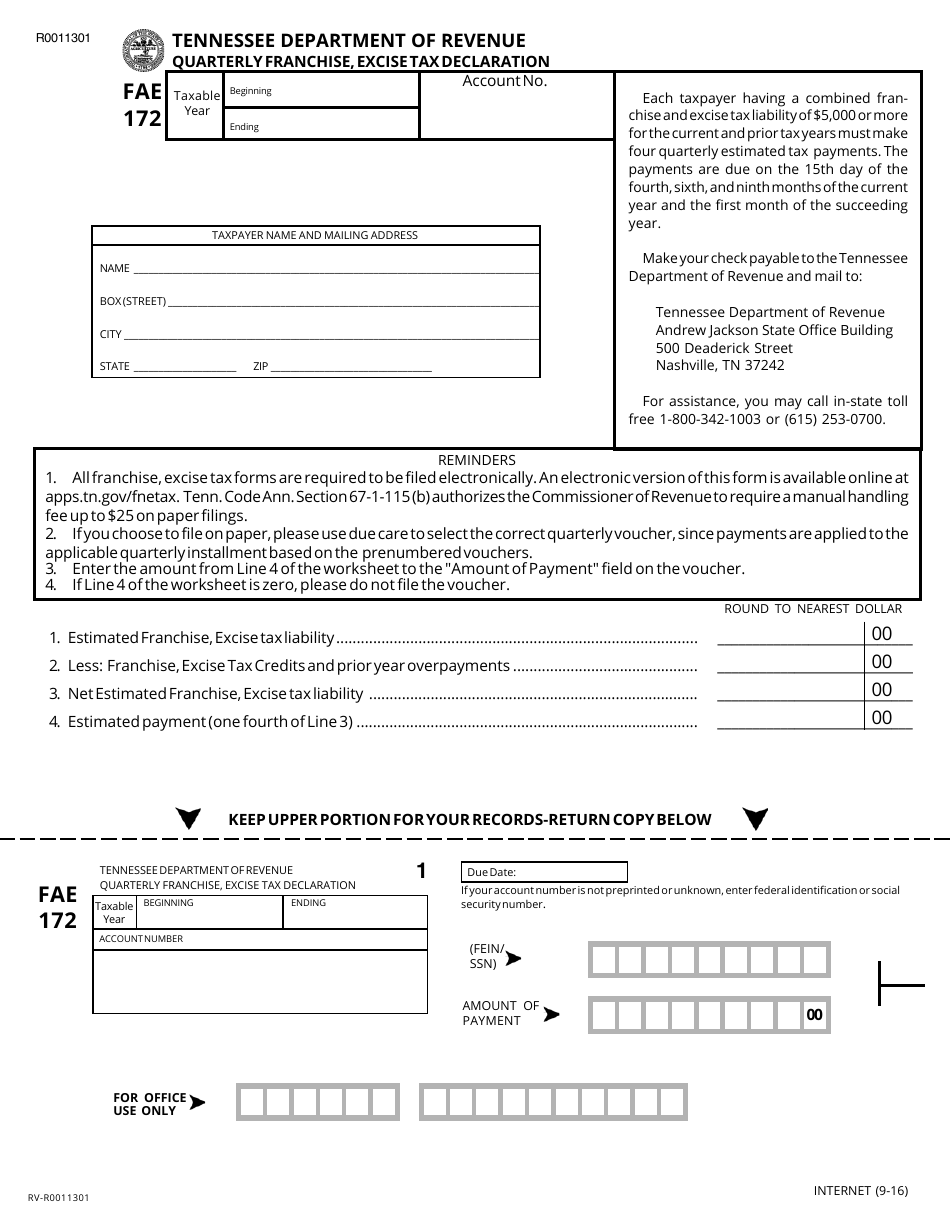

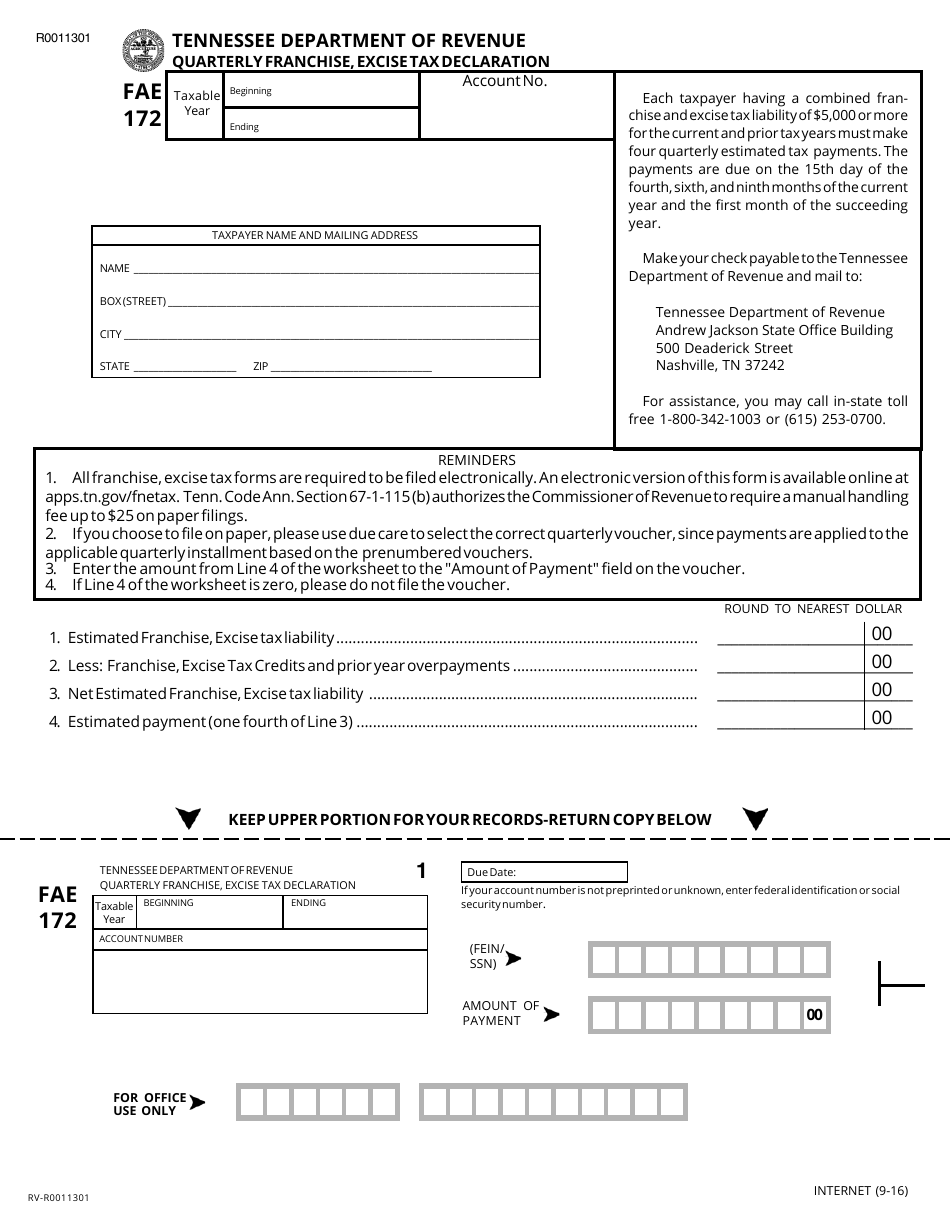

Form Fae172 Download Printable Pdf Or Fill Online Quarterly Franchise Excise Tax Declaration Tennessee Templateroller

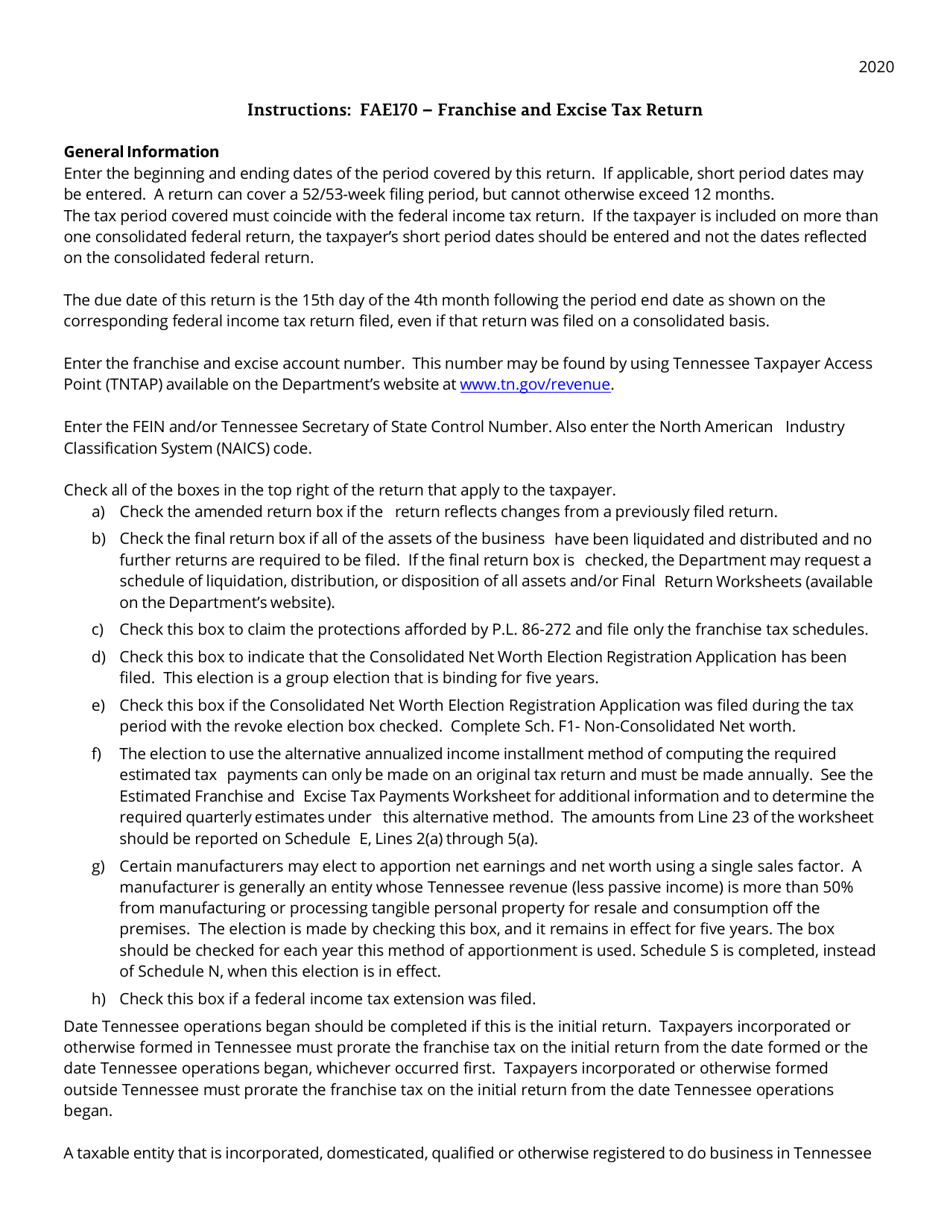

Download Instructions For Form Fae170 Rv R0011001 Franchise And Excise Tax Return Pdf 2020 Templateroller

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

Get And Sign Tennessee Franchise And Excise Tax Form 2017 2022

Form Fae172 Download Printable Pdf Or Fill Online Quarterly Franchise Excise Tax Declaration Tennessee Templateroller

More Help Available For Tennessee Business Owners

Franchise Excise Tax Obligated Member Entities Youtube

Ultimate Excise Tax Guide Definition Examples State Vs Federal

Tennessee Franchise Excise Tax Price Cpas

Tn Dor Fae 170 2019 2022 Fill Out Tax Template Online Us Legal Forms

Free Form Fae 170 Franchise And Excise Tax Return Kit Free Legal Forms Laws Com

Form Fae170 Rv R0011001 Download Printable Pdf Or Fill Online Franchise And Excise Tax Return Tennessee Templateroller

La Pecora Bianca Midtown Can Accommodate Anywhere From 10 To 150 Guests For A Wide Variety Of Private Events In Giulio S Room Restaurant New York Midtown Home

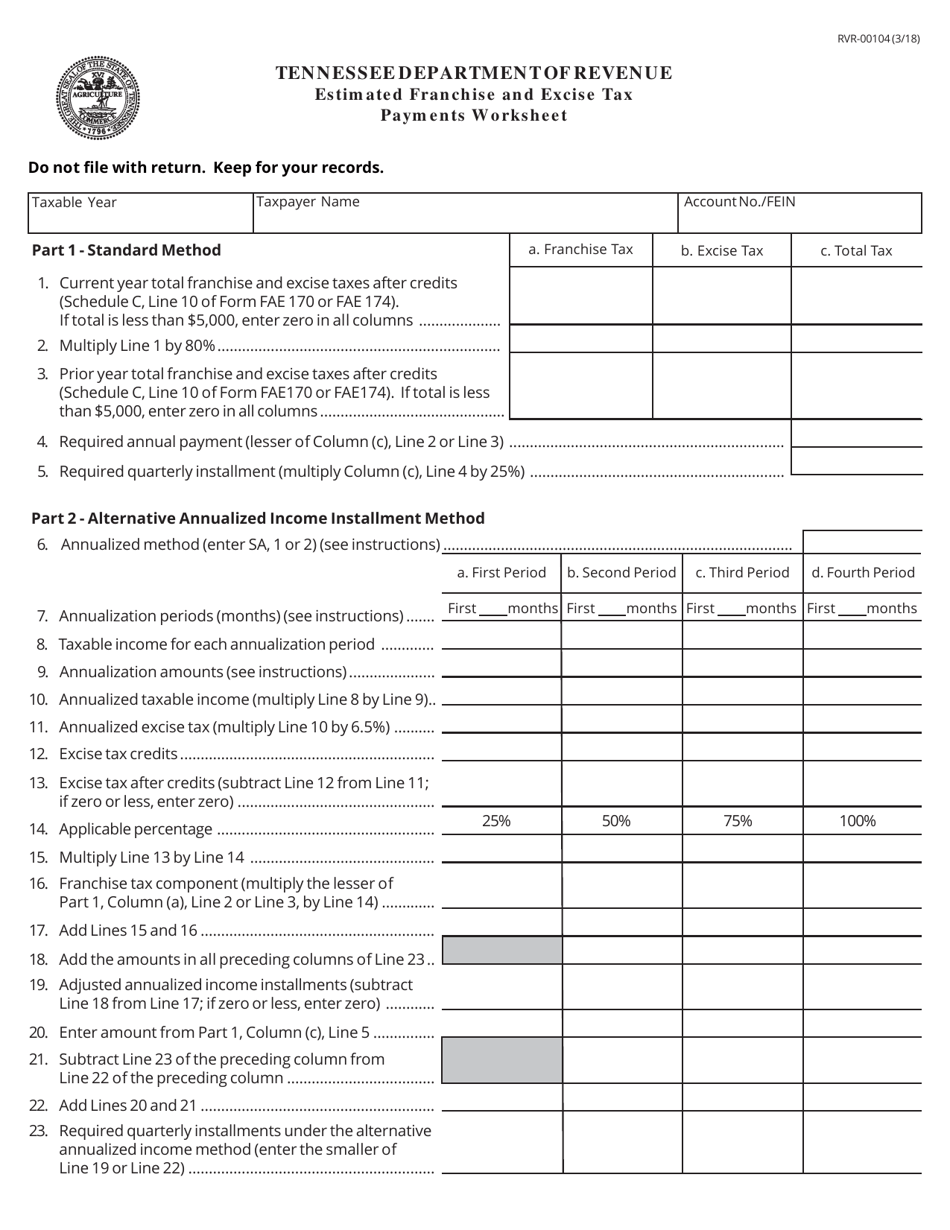

Form Rvr 00104 Download Printable Pdf Or Fill Online Estimated Franchise And Excise Tax Payments Worksheet Tennessee Templateroller

Standard Form 1402 Fill Out And Sign Printable Pdf Template Signnow

Tn Franchise Excise Tax Return Fill Out And Sign Printable Pdf Template Signnow

Download Instructions For Form Fae170 Rv R0011001 Franchise And Excise Tax Return Pdf 2020 Templateroller